/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png) cheapest liability cheaper cars cheapest auto insurance

cheapest liability cheaper cars cheapest auto insurance

A few of the discounts that Clearcover offers to 16-year-old vehicle drivers include: Travelers is a leader in the auto insurance policy space as well as is among the biggest insurance firms nationwide - business insurance. It offers lots of plan alternatives with different protection levels and restrictions for individuals with all various driving practices, so you can constantly locate something that benefits you and your budget, also for young, unskilled drivers.

A few of the discounts that Elephant provides to 16-year-old drivers include: Good student discount Safe motorist discount Security feature discount rates Multi-car discount rate Straight Auto, Unlike other options on the checklist, Straight Car specializes in offering protection to vehicle drivers that are thought about "high-risk" by various other organizations - car. This makes them an exceptional choice for chauffeurs whose driving documents have a couple of incidents on them or those having a hard time to discover economical vehicle insurance policy somewhere else - insurers.

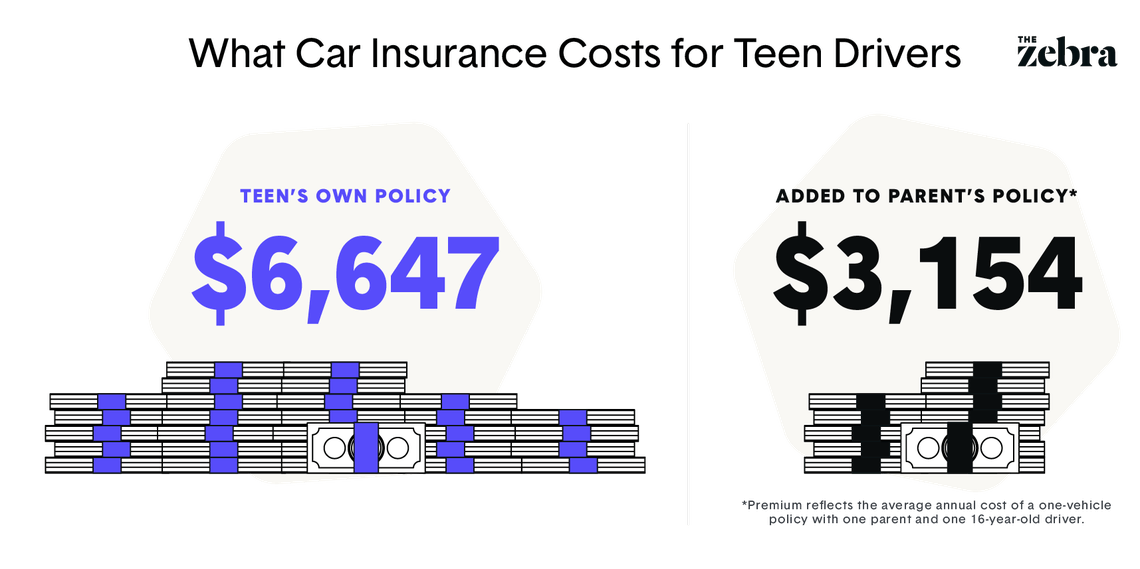

Having a teen chauffeur can obtain expensive, swiftly (insurance). Perhaps one of those young chauffeurs is your teen!

They included a 16-year old teenager to the policy. This is what they saw happen to the prices: The average house's car insurance policy expense climbed 152%.

According to the post, the reason behind the increase was since "teenagers crash at a much higher price than older motorists - insurance companies. Insurance business have to prepare Visit the website for that anticipated incurred price of guaranteeing the motorist.

8 Simple Techniques For How Much Is Car Insurance For A 16-year-old? (2022)

Normally, vehicle insurer won't communicate what price cuts they use to teen chauffeurs unless you ask. Do your research and also know what is available to you. To obtain you started, here are a few of the very best discounts for teenager chauffeurs that will certainly help you obtain cars and truck insurance policy that you can manage.

auto insurance affordable auto insurance affordable accident

auto insurance affordable auto insurance affordable accident

Not every one of these discounts can be utilized at the very same time or integrated together. auto insurance. So ensure you completely recognize what is and isn't accepted by your insurance coverage supplier. Excellent Trainee Discount: Basically, if your teenager shows great grades and also obligation in institution, they obtain a break on the rate of auto insurance policy. laws.

Pupil Away Price Cut: If your teen is away for institution and not driving, ask your provider regarding an "away" discount - vehicle insurance. This can save you around 5%-10%. Elevate Your Insurance deductible: This merely implies you increase the quantity that you are accountable for covering in case of an accident and also is a simple method to lower vehicle insurance costs.

cheap car insurers cars affordable auto insurance

cheap car insurers cars affordable auto insurance

Be sure to ask your representative about the time durations and also when this ends up being readily available to the motorist. Great driving routines are vital to keeping insurance coverage costs low and budget-friendly.

South Carolina has some of the most distracted chauffeurs when driving! South Carolina ranks in the top 5 in the nation for casualties per 100 million vehicle miles took a trip. 982 individuals died in web traffic crashes on our state roads in 2017. That equates to one fatality every 9 hrs.

The Definitive Guide to Average Cost Of Car Insurance For A Teenager - Lovetoknow

Being unskilled behind the wheel of an auto typically leads to greater insurance policy rates, but some companies still use terrific costs (car insurance). Similar to locating insurance policy for any kind of other motorist, finding the very best cars and truck insurance for brand-new vehicle drivers indicates studying as well as comparing prices from carriers - affordable car insurance. In this write-up, we at the House Media examines team will give you a summary of what brand-new vehicle drivers can expect to pay for automobile insurance, that qualifies as a brand-new vehicle driver as well as what factors form the price of an insurance plan.

car insurance business insurance automobile cheapest auto insurance

car insurance business insurance automobile cheapest auto insurance

Who is considered a new chauffeur? Each state sets its very own minimal auto insurance coverage demands, and car insurance policy for brand-new drivers will look the like any kind of various other vehicle driver's policy. While a lack of driving experience does not alter how much insurance coverage you need, it will certainly affect the cost. Below are some instances of individuals who might be thought about new motorists: Teens Older individuals without a driving document Individuals who come in to the U.S.

Car insurance coverage rates by service provider Auto insurance policy for brand-new chauffeurs can differ widely depending upon where you store. Below are several prominent carriers' ordinary yearly prices for complete protection insurance for a 24-year-old with an excellent debt ranking and a good driving record. Auto insurance policy for young adults It can be exciting for a teen to begin driving on their very own for the initial time, however the expense of cars and truck insurance for new drivers is typically high.

Including a young chauffeur to an insurance coverage plan will still boost your costs considerably, however the quantity will depend on your insurer, the automobile and where you live (vans). Teens aren't the just one driving for the first time. cheaper cars. An individual of any age who has actually resided in a large city as well as primarily depended on public transport or that hasn't had the means to purchase an auto could also be taken into consideration a new chauffeur. cheaper car insurance.

The How Much To Add A Teenager To Car Insurance? - Car And ... PDFs

Despite the fact that you may not have experience on the roadway, if you're over 25, you may see lower prices than a teen motorist. Another point to think about is that if you stay in an area that has public transit or you do not intend on driving much, there are alternatives to traditional insurance, like usage-based insurance coverage (cars).